Firstly, business aside. Let us ask you: Have you ever made lemonade? In the beginning, you have the basic ingredient - lemon juice. And then there is water - and the more water you add, the less part of the drink will actually consist of the lemon juice itself. This is how dilution works in everyday life.

Dilution in business has a small difference - there are company founders´ shares instead of lemon juice and newly issued shares coming with every investment instead of water.

Simple as that but at the same time so much more difficult that many business founders get it all wrong - and then face unpleasant consequences.

Dilution is an extremely important subject to understand because whenever there is a new investment in the company, it directly affects the founders and other existing shareholders. And we are here to help you get it right.

In the first part of the dilution series, we will dive into the very basics and define what equity dilution is, why founders accept it and what are its effects on a business.

What is equity dilution?

Typically, the ownership of a company is represented by shares. In the beginning, business founders own all of them or 100% of the company. But what do these founders need to grow their company and reach for the stars? Yes, you are right - they need money.

Since shares are the only thing of value that they can exchange for money, they need to give shares to every new investor. Remember what we wrote earlier? Shares = ownership of a company. In practice, that means the founders are giving up a certain portion of their company in exchange for growth capital.

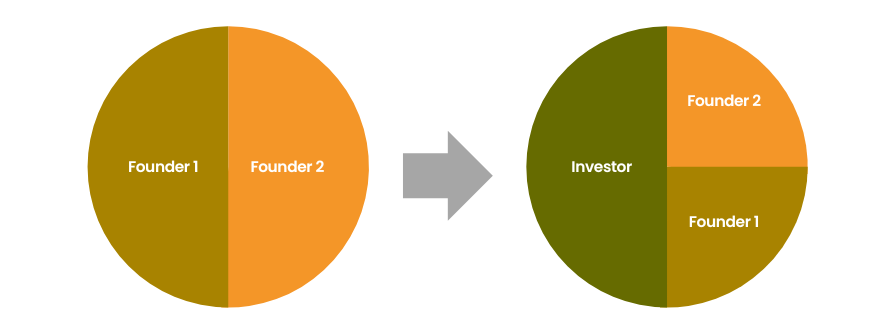

Let's illustrate this by a simple example. A business is founded by two founders with total capital 100 000€. The company issues 100 000 shares of 1€ each and each founder takes 50 000 - so each founder owns 50% of the company. Later, they decide to take an investment of 100 000 € and hence additional 100 000 shares need to be issued and given to the investor. Now the following happens: each founder´s ownership of the company decreased to 25%, while the investor owns 50% of the company.

This process of decreasing the ownership percentage of a company with new investments is called equity dilution, stock dilution or even share dilution.

Why do business founders accept dilution?

Did you just think if the dilution is really inevitable or there is a better way to fund your company? The answer is yes - you can definitely avoid dilution by taking debt. However, that is not always possible for businesses in their early stages.

Just think about it. A startup with a promising idea is founded, but it can take months or even years to start generating real profits. Though you do not generate any revenue yet, you still need money to grow. And if you wish to take debt, you need to show the numbers which prove that your business is able to repay it - which is harder than it seems.

Though providers of debt financing are not willing to take the risk to fund unprofitable businesses, VCs and angel investors are different - if they think your startup is good enough, they will invest in your business, take its shares and believe that they will earn much more money in the future. And since founders are desperate for money, they do not object. In the end, it is the easiest way.

However, investors are not the only ones hoping for a successful business. This is, in the first place, the founders´ main goal - and since a large portion of ownership is lost in the process of dilution, they aim for the value of the startup to increase as much as possible, so that in the end they own a smaller percentage of a much bigger and profitable company.

What are the effects of equity dilution?

Losing a portion of ownership of a business due to dilution has a direct effect on the role of founders in their own companies.

Among the most important ones are the following:

- Share of profit distribution

Everyone who owns shares in a company has a right to receive their part of the company's profits. How much money you get depends on how many shares you own and, of course, the value of the company. The more shareholders are in play, the more profits the founders need to share with them. - Share of leftover assets

If a dissolution of the company happens, all shareholders have the right to receive a portion of the assets left after paying taxes, suppliers or debt investors. - Decision-making power

Larger ownership means bigger power. Once investors give you money, they want to have a say in the company's issues. And if the founder's percentage of ownership decreases too much, they might lose the ability to decide the fate of the company they created.

The bottom line

From the business founder´s view, equity dilution has both a bright and a negative side. Most importantly, growing your business without capital would not be possible and if you are left with no other choice, every founder will agree to exchanging it for a part of their company. However, you need to be careful and plan ahead because dilution adds up over time and it can leave you, if done incorrectly, almost empty-handed.

In the second part of our equity dilution series, we will look into the impact equity dilution has on business founders.