Revenue-based financing: What is a big deal?

For a long time, there was no good option for a growing business to raise capital – in the case of VC (Venture Capital), you have to make peace with giving up a portion of your company's ownership, your decision making power and also some board seats, while when borrowing from a bank, you have to not only put your own personal assets at stake but also you get hit by unpleasant agreements, which are everything but transparent.

And we still have not mentioned the long hours of paperwork, which are wasting all your energy and valuable time!

But what if we told you that there was a better way how to fund your business – a way, which not only provides you with needed capital but is also putting the best interests of your company in the first place? Say no to dilution, personal guarantees, and stress about finance. Say yes to flexible repayments, simplicity, peace of mind and growing your company.

Say YES to revenue-based financing!

What is revenue-based financing?

Revenue-based financing, Royalty-based financing, Revenue sharing... Maybe you have heard all of it and maybe none – both are okay.

All those different names represent a form of funding, in which an investor provides growth capital to a company in exchange for a fixed percentage of its monthly revenues.

There is no equity and no external collateral involved.

So how exactly does the repayment system work?

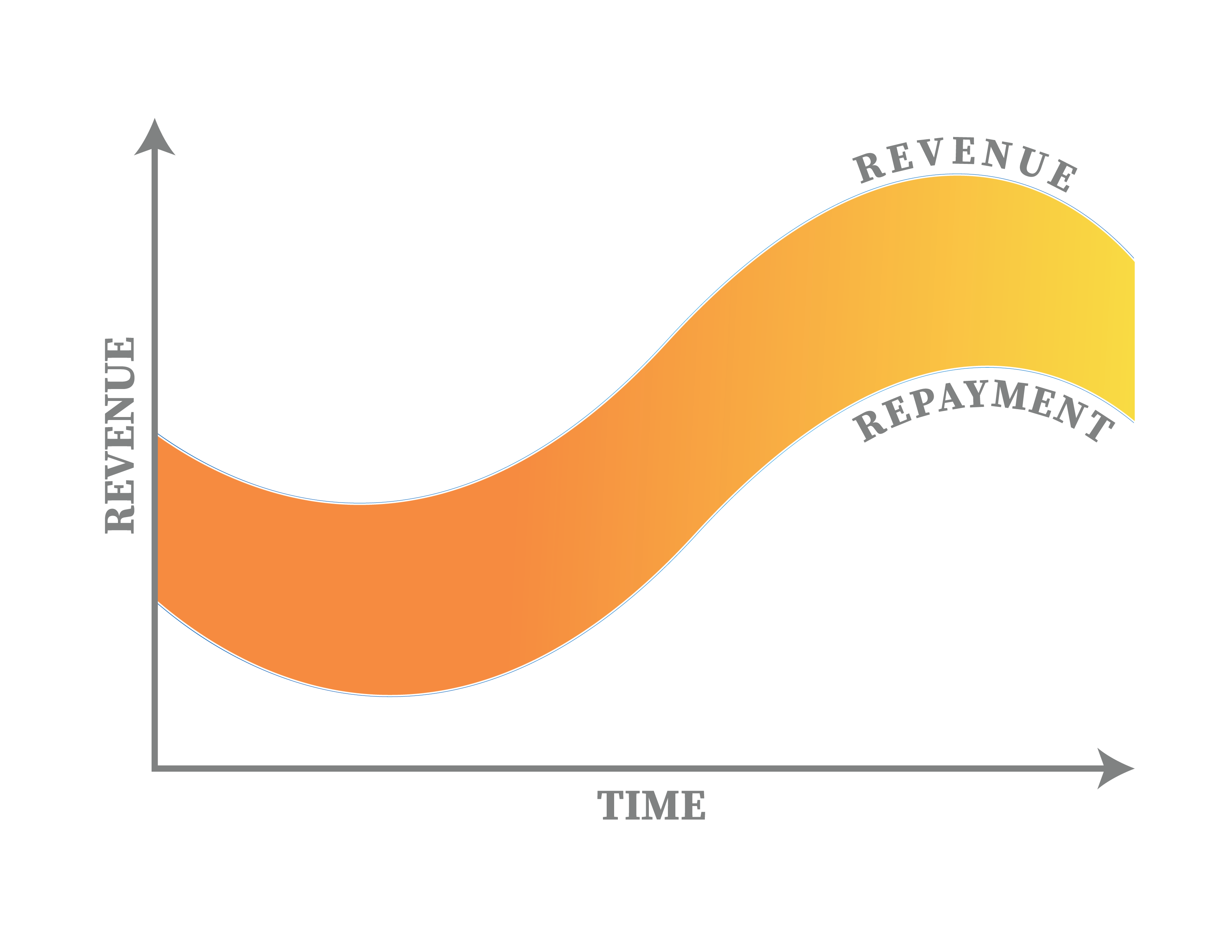

Flexible repayment system

The true magic of the revenue-based financing system comes from its flexibility. Since the company repays a fixed percentage of its revenue, in practice it means that if your revenues decrease, your monthly repayment amount decreases as well and vice versa. So, if you hit difficult times, the repayments of RBF will not financially devastate you.

And how is the total repayment amount calculated? The investor will simply calculate the repayment amount using a certain multiple, which will be higher than the original investment and will serve as the investor's return on investment.

For a better understanding, let's have a look at a very simple example. Imagine that your company needs €800K for the development of a new product and you are willing to repay 10% of your future revenues. Since your company is in a good standing with annual revenue €1M, the investor calculates the total repayment of €1.4M (1.75 x principal amount), which is expected to be repaid in the next 6 years.

Now imagine that your company is doing really well, your revenues increase significantly and you happen to repay the total amount of €1.4M in 5 years. Will you continue to pay for another year? No! Your repayments are officially over together with all the obligations towards the investor.

Sounds too good to be true? And you still have not read about all the benefits!

Benefits of revenue-based financing

Compared to other common ways of raising growth capital, revenue-based financing brings to the founders several benefits. Among the most important ones are the following:

Keeping full control - In the case of revenue-based financing, the investor trusts that the founders know what is best for their company and thus do not get involved in any decision-making processes nor take any board seats.

Flexibility - It is just natural that every company will face some difficulties from time to time. As you go through hard times and your revenues decrease, so do the repayments.

Quick access to capital - Instead of waiting months for your money (and delaying your company's growth at the same time), the usual time period within which you will receive the funding with RBF is usually only around 2 weeks.

Simplicity - The repayment system is very easy to understand and follow. There is nothing that could possibly surprise you on the way, which allows you to fully concentrate on running your business.

More accessible than other funding options - It often happens that companies that are eligible for revenue-based financing are refused by banks or VCs because they do not comply with all their commonly high criteria. If you are the right fit, RBF will back you up when no one else is willing to help you.

For which companies is revenue-based financing suitable?

Generally speaking, any company that complies with the following criteria is eligible to receive the funding:

Annual revenue at least €250K - If your revenue for the past 12 months hit the magical number €250,000 you can consider yourself eligible.

Growth potential - In order to be suitable for receiving the funding, your company needs to be already profitable or very close to profitability.

Minimum 2 years of trading - Revenue-based financing is not suitable for recently founded companies, however, if you are active for more than 2 years, you are ready to go.

What do I need to do to get access to revenue-based financing?

The very first step is sending the registration form, which contains basic questions about your business and filling the form in requires less than 5 minutes of your time.

Our staff will check your eligibility and contact you afterwards in order to arrange a call with you, during which we will learn more about your business and also you will learn more about who we are.

A part of the call will be also answering our unique questionnaire, based on which we will be able to assess your company and create an offer for you.

The offer will be valid for 6 months, so you can take your time to think everything through and request the financing whenever you are ready to grow.

Once we make the final check, it will take no more than 2 weeks until your money arrives at your company's bank account.

Scale-up your business with accessible growth capital

If you have read this article up to this point, you are very well aware that revenue-based financing is – compared to other common fundraising options – the founder-friendly way to raise capital, for which you were waiting for a long time to come.

You can finally stop worrying about finance and get back to what is truly important. Hit the register button and start your journey to growing your business NOW.